© ROC Investment Ltd, Rämistrasse 31, 8001 Zurich, Switzerland, +41(0)442091555

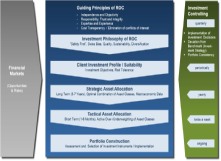

ROC’S INVESTMENT PROCESS

INVESTMENT PHILOSOPHY

Trying to invest under the current economic conditions is not a trivial matter. We

are fully aware and sensitive of the challenges and risks of investing. Our long-lasting

proven investment philosophy provides relative and absolute superior investment results

over a full economic cycle by identifying valuation inefficiencies applying behavioral

finance. We adopt an investment approach with a clear Swiss bias, considering a high

Swiss franc quota and direct investments in Swiss stocks. With the exception of very

specific investment products, we use funds and structured products on a restrictive

basis only. Wherever possible and reasonable we prefer to invest directly in equities

and bonds. It is our motivation to rigorously implement our strategy and to avoid

hidden costs and risks for our clients.

CLIENT INVESTMENT PROFILE - SUITABILITY OF INVESTMENTS

Understanding our client’s financial situation and expectations is essential for

us to define an appropriate investment strategy for each individual client. In a

personal discussion we define a suitable strategy together with you, taking into

consideration numerous factors such as the type and amount of your assets, liquidity

needs, investment goals and horizon, risk tolerance/ability and your reference currency.

STRATEGIC & TACTICAL ALLOCATION - PORTFOLIO CONSTRUCTION

We combine “top down” with a “bottom up” investment selection and profound analysis

which are reflected in our investment themes. We take great care to benefit from

diversification effects on all levels (regions, industries, company size, long-term

themes as well as short-term opportunities). ROC uses a large information network

and is in constant contact with industry experts, company analysts and investors

around the globe.

Today’s investment environment is complex and unpredictable.

A structured investment process therefore is more important than ever.